What to Trade this Week as Central Banks Diverge Amidst Trade War Tensions

The Forex Market Roundup

Monday, February 10, 2025, Week 7

Welcome to this week's forex market outlook. The dominant theme we'll be tracking over the next ten days is the divergence in central bank policies. The RBNZ and BoE are expected to continue easing, while the Fed appears to be holding steady, at least for now. Key economic events tied to this theme include the RBNZ rate decision on February 19th and several important data releases that could influence central bank policy.

Currency Strength Overview:

USD: Very Strong / Bullish (Unchanged).

JPY: Strong / Bullish (Unchanged).

CHF: Moderately Strong / Moderately Bullish (Unchanged).

EUR: Weak / Bearish (Unchanged).

GBP: Weak / Bearish (Unchanged).

CAD: Weak / Bearish (Unchanged).

NZD: Very Weak / Very Bearish (Unchanged).

New Zealand Dollar: Kiwi's Recession Troubles Deepen

The dominant theme for the NZD remains the RBNZ's dovish monetary policy and the ongoing technical recession. The NZD has been under pressure from weak domestic demand, contracting manufacturing and services sectors, and the RBNZ's clear easing bias. More recently, weak Q4 employment data, showing a rise in the unemployment rate to 5.1%, has further solidified expectations of a 50 bps rate cut at the RBNZ's February 19th meeting.

While there have been some positive surprises in the data, like stronger retail sales in December, these have been largely overshadowed by the negative growth narrative. The new government's fiscal stimulus measures, including tax cuts and infrastructure spending, are a potential long-term positive, but the market is focused on the more immediate concern of the recession.

The RBNZ meeting will be the next key event. A 50 bps rate cut is almost fully priced in, so the market reaction will depend on the RBNZ's forward guidance. Any indication of further aggressive easing could send the NZD tumbling further. Conversely, a more cautious tone might provide some short-term relief. The Business NZ PMI for January, due on February 13th, will also be important. Another contraction in manufacturing would reinforce the negative sentiment, while an unexpected expansion could offer some support. Global risk sentiment, particularly US-China trade relations, remains a crucial factor. Any escalation in tensions could weigh on the NZD.

The fundamental outlook for the NZD remains very bearish. The RBNZ's dovish stance, the technical recession, and global risk aversion create a challenging environment. The COT report (Jan 28th) shows Asset Managers and Leveraged Funds net short, indicating that the market is already positioned for further NZD weakness. This suggests limited downside potential in the very short term, but the overall trend remains down.

Upcoming New Zealand Economic Indicators

Feb 13: Business NZ PMI (JAN). Forecast: 46. Continued contraction in manufacturing would reinforce the negative outlook.

Feb 19: RBNZ Interest Rate Decision. Forecast: 3.75%. A 50 bps cut is widely expected, potentially sending the NZD lower.

Feb 20: Balance of Trade (JAN). Forecast: NZ$0.5B. A smaller surplus or a deficit could add to the NZD's woes.

Australian Dollar: Aussie's China Conundrum and RBA Rate Cut Watch

The dominant theme for the AUD has been the increasing likelihood of RBA rate cuts, driven by weaker-than-expected Q3 GDP growth and dovish commentary from RBA officials. This narrative intensified recently with the release of softer-than-expected Q4 inflation data (2.4% YoY), further cementing rate cut expectations. The narrowing trade surplus in December added to the AUD's woes.

An emerging theme has been the resilience of the Australian labour market, with stronger-than-expected employment data in December. However, this has been largely overshadowed by broader economic concerns and the RBA's dovish tilt.

The RBA's February 18th meeting will be the next key event. A rate cut is now highly likely, and the market's reaction will depend on the size of the cut and the RBA's forward guidance. The Westpac Consumer Confidence Index and NAB Business Confidence for January, both due on February 11th, will provide further insights into domestic sentiment. Weaker readings could reinforce the negative outlook for the AUD. Globally, US-China trade relations and the overall risk sentiment remain crucial. Any escalation in trade tensions or a further deterioration in China's economic outlook could weigh on the AUD.

The fundamental outlook for the AUD remains bearish. The combination of RBA easing bias, concerns about China's economic slowdown, and USD strength creates significant headwinds. The COT report (Feb 4th) shows a bearish bias, with Asset Managers net short, suggesting further downside potential.

Upcoming Australian Economic Indicators

Feb 11: Westpac Consumer Confidence Change (FEB). A further decline would signal ongoing economic anxieties.

Feb 11: Westpac Consumer Confidence Index (FEB). A low reading would point to persistent pessimism.

Feb 11: NAB Business Confidence (JAN). Weaker business confidence would reinforce the negative outlook.

Feb 18: RBA Interest Rate Decision. Forecast: 4.10%. A rate cut is highly likely, which would probably send the AUD lower.

Swiss Franc: Safe-Haven Franc Shines Amidst Global Storms

The Swiss Franc (CHF) has benefited from its safe-haven status, driven by global uncertainties, including political turmoil in South Korea and France, and escalating US-China trade tensions. This safe-haven demand has been the dominant theme, pushing the CHF higher despite the SNB's dovish monetary policy. More recently, Trump's tariff announcements and the tech sell-off further fuelled safe-haven flows into the CHF. The better-than-expected consumer confidence reading for January added to the CHF's strength.

While the 50 bps rate cut in December created some initial CHF weakness, this has been largely overshadowed by the safe-haven demand. The SNB's easing bias remains an underlying factor to consider, but the market is currently more focused on global risks.

Any further escalation in trade tensions or geopolitical risks could send the CHF higher. The SNB's next policy assessment is not until March 20th, but any comments from SNB officials hinting at further easing or intervention could temper the Franc's strength. The inflation data for January, due on February 13th, will be an important indicator to watch. Lower-than-expected inflation could reinforce the SNB's dovish stance.

The fundamental outlook for the CHF is moderately bullish. While the SNB's easing bias is a headwind, the safe-haven demand remains a powerful supporting factor. The COT report (Feb 4th) shows Leveraged Funds moderately net long, suggesting some bullish conviction.

Upcoming Swiss Economic Indicators

Feb 13: Inflation Rate YoY (JAN). Lower-than-expected inflation could reinforce SNB's dovish stance.

Feb 18: Industrial Production YoY (Q4). Weak data could add to concerns about the Swiss economy.

Feb 20: Balance of Trade (JAN). A smaller surplus could weigh on CHF.

Mar 20: SNB Interest Rate Decision. Any change in rate or forward guidance will be a major market mover.

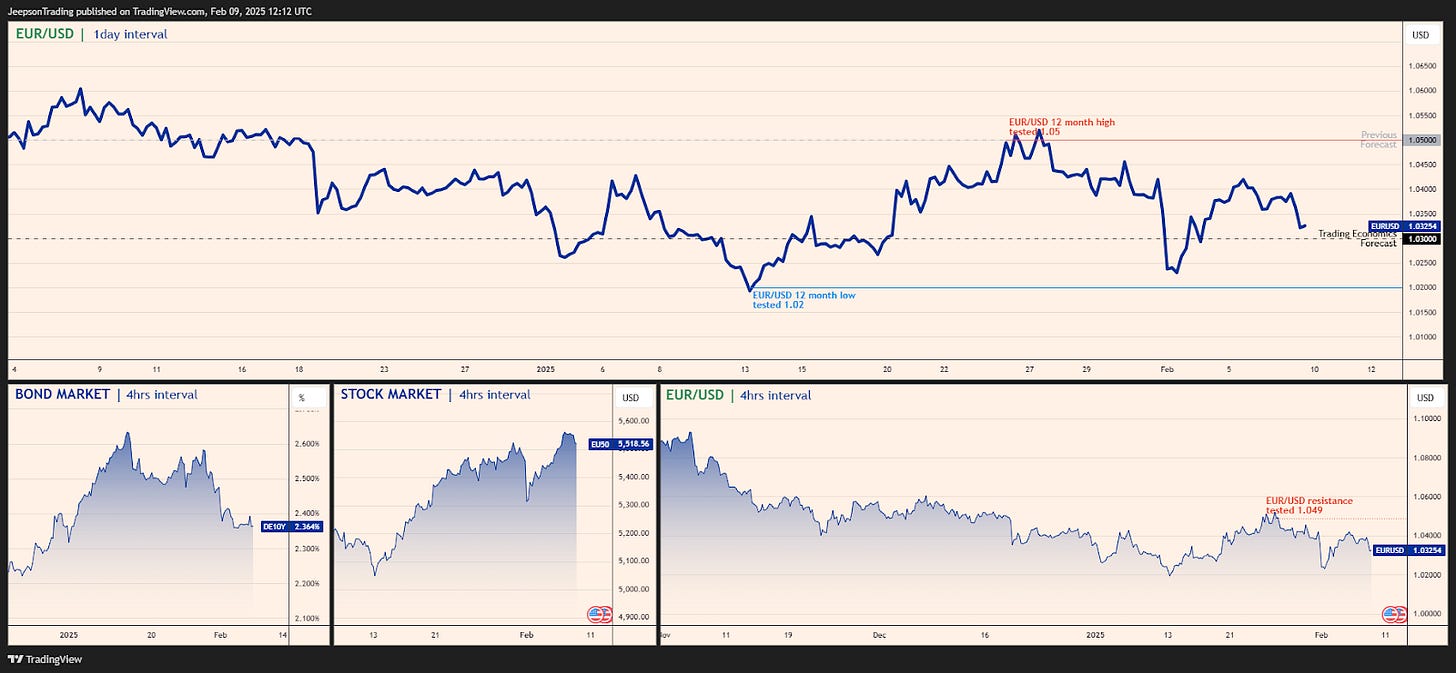

Euro: Euro Under Pressure from Dovish ECB and Political Risks

The dominant theme for the Euro (EUR) has been the ECB's dovish monetary policy and concerns about slowing economic growth in the Eurozone. The January 30th rate cut to 2.90% and the accompanying dovish communication reinforced expectations of further easing, putting downward pressure on the EUR. Recently, weak economic data, including stagnant Q4 GDP growth and rising unemployment in December, has added to the negative sentiment. The slightly higher-than-expected inflation for January (2.5%) has done little to change the overall bearish outlook.

Political uncertainty in Germany and France, with upcoming snap elections in Germany and a new government in France, is an emerging theme that is adding to the EUR's woes. These political risks are creating uncertainty about the future direction of economic policy in the Eurozone's two largest economies.

Over the next several days, the focus will be on the second estimate of Q4 GDP growth, due on February 14th. A confirmation of weak growth could further pressure the EUR. The ECB's communication will also be closely watched for any further dovish signals. Globally, the US-China trade war and the overall risk sentiment remain important factors. Any escalation in trade tensions could weigh on the EUR.

The fundamental outlook for the EUR is bearish. The ECB's dovishness, weak economic data, and political uncertainty create significant headwinds. The COT report (Feb 4th) shows mixed positioning, with Leveraged Funds net long but Dealers notably net short, suggesting the potential for further EUR weakness.

Upcoming Euro Area Economic Indicators

Feb 14: GDP Growth Rate QoQ 2nd Est (Q4). Confirmation of weak growth could pressure EUR.

British Pound: Sterling's Struggle Continues Amidst BoE Easing

The British Pound (GBP) has been under pressure from the Bank of England's (BoE) dovish monetary policy and concerns about the UK's economic slowdown. The BoE's rate cut to 4.5% on February 6th, along with weak economic data (construction PMI, retail sales, consumer confidence) and the BoE's downward revision of growth forecasts, has reinforced the negative sentiment.

Over the next several days, the focus will be on the preliminary Q4 GDP data, due on February 13th. Weaker-than-expected growth could further pressure the GBP. The unemployment rate for December, also due on the 13th, will be another important indicator to watch. Globally, the US-China trade war and the overall risk sentiment remain important factors. Any escalation in trade tensions could add to GBP weakness.

The fundamental outlook for the GBP remains bearish. The BoE's dovishness, weak economic data, and global risk aversion are significant headwinds. The COT report (Feb 4th) shows mixed positioning, with leveraged funds moderately net long and asset managers net short, reflecting uncertainty.

Upcoming United Kingdom Economic Indicators

Feb 13: GDP Growth Rate QoQ Prel (Q4). Weaker-than-expected growth would reinforce the negative outlook.

Feb 13: GDP Growth Rate YoY Prel (Q4). A low reading would signal persistent economic weakness.

Feb 13: GDP MoM (DEC). A contraction in monthly GDP would add to concerns.

Feb 13: GDP YoY (DEC). Weak annual growth would further weigh on the GBP.

Feb 18: Unemployment Rate (DEC). A rising rate would reinforce the negative sentiment.

Feb 19: Inflation Rate YoY (JAN). Higher-than-expected inflation could complicate the BoE's policy decisions.

Canadian Dollar: Loonie Weighed Down by Tariffs and Trudeau's Exit

The Canadian Dollar (CAD), or "Loonie," has been under pressure from multiple headwinds, primarily US tariff threats and domestic political uncertainty following Trudeau's resignation. The BoC's dovish monetary policy, including the recent rate cut to 3.00% and the resumption of asset purchases, has further weakened the CAD. The continued weakness in oil prices has exacerbated the negative sentiment.

Over the next several days, US-Canada trade relations will be the key driver for the CAD. Any signs of easing tensions could provide some relief, while further escalation could send the CAD lower. The inflation data for January, due on February 18th, will be an important indicator to watch. Higher-than-expected inflation could limit the BoC's ability to ease further. The selection of a new Liberal leader and the upcoming federal election add to the political uncertainty.

The fundamental outlook for the CAD remains bearish. US tariff threats, BoC dovishness, weak oil prices, and Canadian political uncertainty are significant headwinds. The COT report (Feb 4th) shows significant net short positions from Asset Managers and Leveraged Funds, suggesting further downside potential.

Upcoming Canadian Economic Indicators

Feb 18: Inflation Rate YoY (JAN). Higher-than-expected inflation could limit BoC easing.

US Dollar: King Dollar's Reign Tested by Trade Wars and Tech Tremors

The US Dollar (USD) has benefited from its safe-haven status amid global uncertainty, driven by President Trump's trade policies and the tech sell-off. The Fed's hawkish shift, signalling a slower pace of rate cuts, has also supported the USD. However, the mixed US economic data, including weaker-than-expected retail sales and slowing GDP growth, has introduced some uncertainty.

Over the next several days, US-China trade relations will be the key driver for the USD. Any further escalation in tensions could boost the USD's safe-haven appeal, while signs of negotiation could weaken the currency. Fed Chair Powell's testimony on February 11th and the FOMC minutes from the January meeting, due on February 19th, will be closely watched for clues about the Fed's policy outlook. US economic data, particularly the CPI and PPI reports for January, will also be important.

The fundamental outlook for the USD is bullish, but with some caveats. The safe-haven demand and the Fed's relatively hawkish stance are supportive factors. However, Trump's trade policies and the potential for a US economic slowdown create uncertainty. The COT report (Feb 4th) shows mixed positioning, with Asset Managers net long and Leveraged Funds net short, reflecting this uncertainty.

Upcoming US Economic Indicators

Feb 11: Fed Chair Powell Testimony. Powell's comments will be crucial for gauging the Fed's outlook.

Feb 12: Inflation Rate YoY (JAN). Higher-than-expected inflation could strengthen the USD.

Feb 12: Core Inflation Rate YoY (JAN). This will offer insights into underlying inflation trends.

Feb 19: FOMC Minutes. Further insights into the Fed's policy outlook.

Key Takeaways and Top Upcoming Indicators

The main theme is central bank policy divergence and the impact of US trade policy. Watch for any surprises in US inflation data and Fed Chair Powell's testimony. The UK's Q4 GDP data will be crucial for the GBP, while the AUD will be sensitive to any news regarding US-China trade relations.

Top Upcoming Economic Indicators:

Feb 11: Fed Chair Powell Testimony (USD).

Feb 12: US Inflation Rate YoY (JAN) (USD).

Feb 13: UK GDP Growth Rate QoQ Prel (Q4) (GBP).

Sources

Financial Juice, Bloomberg, Reuters, Trading Economics, ForexLive, Federal Reserve, ECB, BOJ, BOE, RBA, RBNZ, SNB, BOC, US Bureau of Labor Statistics, Eurostat, Statistics Canada, Australian Bureau of Statistics, Statistics New Zealand, Swiss Federal Statistical Office, Office for National Statistics, Cabinet Office Japan, Ministry of Internal Affairs and Communications, Ministry of Finance Japan.