What to Trade this Week as More Central Bank Rate Cuts Expected

The Forex Market Roundup

Monday, February 17, 2025, Week 08

Central bank policies are diverging. RBNZ and RBA are expected to cut rates due to slowing economies and low inflation, while the Federal Reserve is more cautious. Key events this week include the RBNZ and RBA rate decisions and the FOMC minutes, which will provide insight into future rate adjustments and impact currency markets.

Currency Strength Overview (Strongest to Weakest):

USD: Strong / Bullish (Unchanged). The USD's strength is based on safe-haven demand and the Fed's relatively hawkish stance.

JPY: Strong / Bullish (Unchanged). The BOJ's surprise rate hike and potential for further tightening support JPY.

CHF: Moderately Strong / Moderately Bullish (Unchanged). Safe-haven demand supports CHF, but SNB easing bias limits upside.

GBP: Weak / Bearish (Unchanged). BoE dovishness and UK economic concerns weigh on GBP.

EUR: Weak / Bearish (Unchanged). ECB dovishness, weak Eurozone data, and political risks pressure EUR.

CAD: Weak / Bearish (Unchanged). US tariff threats, Trudeau's exit, and BoC dovishness weaken CAD.

NZD: Very Weak / Very Bearish (Unchanged). RBNZ's dovish policy and the ongoing recession pressure NZD.

New Zealand Dollar: Kiwi's Recession and the RBNZ

The dominant theme for the NZD over the past seven weeks has been the RBNZ's dovish monetary policy and the ongoing technical recession. The RBNZ cut the OCR to 4.25% in November, and the market is pricing in another 50 bps cut at the February 19th meeting. This dovish outlook is fuelled by weak economic data, including the confirmed contraction in Q2 and Q3 2024 GDP and rising unemployment (5.1% in Q4). The dominant narrative over the past seven days, however, has shifted slightly towards potential economic stabilization. The January Manufacturing PMI surprisingly showed expansion (51.4), the first in nearly two years, and the NZD posted a second consecutive weekly gain. This positive PMI data temporarily overshadowed concerns about rising food prices (2.3% YoY in January).

The emerging theme is the mixed bag of economic signals. While the recession and weak domestic demand persist, there are glimmers of hope. Improving consumer confidence, a narrowing trade deficit, and stronger retail sales suggest potential stabilization. However, the overall narrative remains cautious, with the recessionary backdrop still a major concern.

Looking ahead, the RBNZ's rate decision and accompanying statement on February 19th will be the key driver for the NZD. A 50 bps cut is largely priced in, so the focus will be on the RBNZ's forward guidance. Any indication of a more aggressive easing path could send the NZD lower, while a more cautious tone might provide some short-term support. The Q4 GDP data, also due on the 19th, will be crucial for confirming the depth of the recession or signalling a potential recovery. US-China trade relations remain an important external factor. Any escalation in tensions could weigh on the NZD.

The fundamental outlook for the NZD remains very bearish. The combination of RBNZ easing, the recession, and global risk aversion creates strong headwinds. The COT report (as of Feb 11th) shows large net short positions, indicating that much of the negative sentiment is already priced in. However, the recent positive Manufacturing PMI and the potential for a less aggressive RBNZ could limit further downside in the very short term. I would consider selling the NZD, but with tight risk management, given the potential for short-term volatility.

Upcoming New Zealand Economic Indicators

Feb 19th: RBNZ Rate Decision. Forecast: 3.75%. A 50 bps cut is widely expected and could weaken NZD further.

Feb 20th: Balance of Trade (JAN). Forecast: NZ$0.5B. A smaller surplus could add to NZD weakness.

Australian Dollar: Aussie's Balancing Act

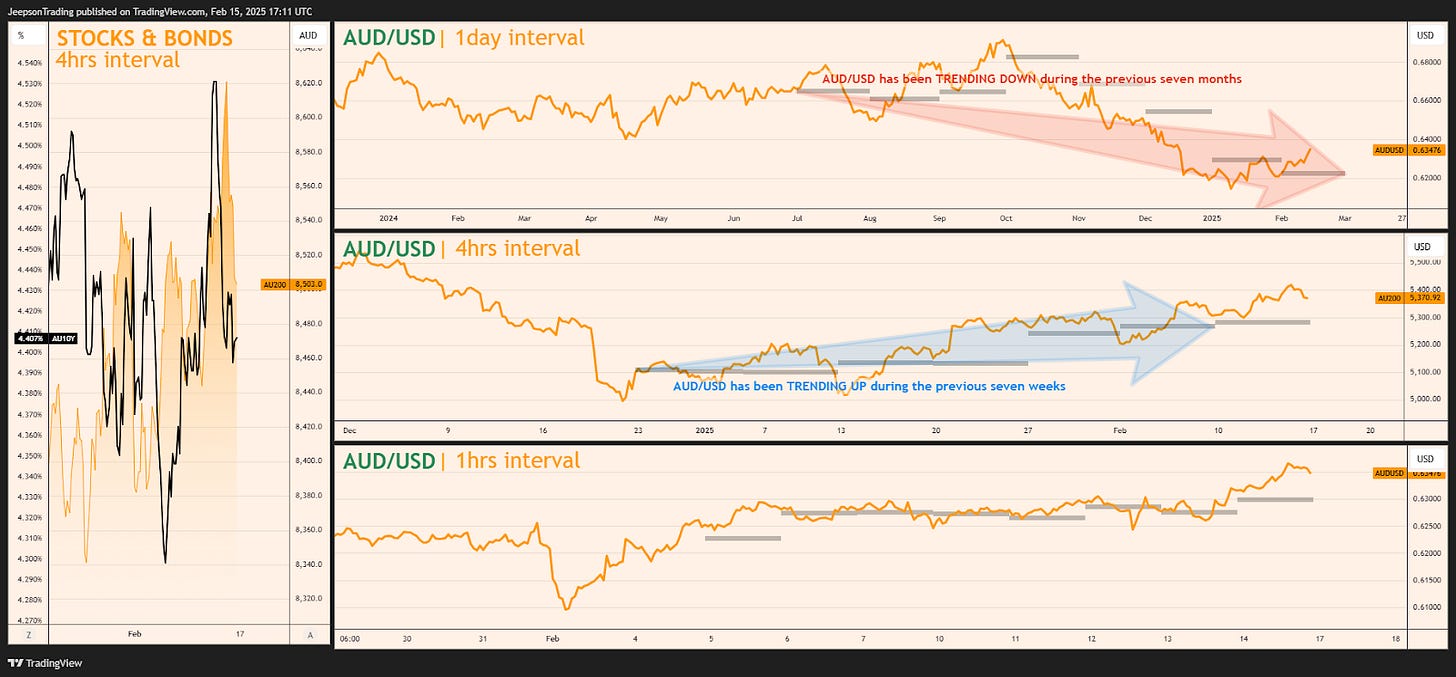

The dominant theme for the AUD over the past seven weeks has been the increasing likelihood of RBA rate cuts, fuelled by weaker-than-expected Q3 GDP growth and dovish RBA commentary. This was reinforced by the softer-than-expected Q4 inflation print of 2.4% YoY (released Jan 29th). The dominant narrative over the past seven days has been more positive, driven by a combination of AUD strength (closing above $0.632 on Feb 14th), surging iron ore prices (up 2.11% on Feb 14th), and signals from the PBoC (on Feb 14th) indicating a willingness to adjust policy to support growth.

The emerging theme has been the resilience of the Australian labour market, as evidenced by the stronger-than-expected December employment data (released Jan 12th). This positive data point has created some uncertainty about the timing and extent of RBA easing.

Looking ahead, the RBA's interest rate decision on February 18th will be the primary driver of AUD movement. A rate cut is now highly anticipated, and the market's reaction will depend on the size of the cut and the RBA's forward guidance. The unemployment rate for January (due Feb 20th) will be another important indicator. A higher-than-expected unemployment rate could reinforce the dovish outlook and pressure the AUD. China's economic data and policy decisions remain crucial, as any signs of further stimulus could support the AUD. US-China trade relations are also a key factor, with escalation potentially weighing on the AUD and de-escalation offering support.

The fundamental outlook for the AUD is bearish, but the recent strength driven by commodity prices and China's easing signals creates a more balanced near-term outlook. The COT report (as of Feb 11th) shows bearish positioning from Asset Managers and Leveraged Funds, suggesting much of the negative sentiment may already be priced in. However, the uncertainty surrounding the RBA's actions and the US-China trade situation warrants a cautious approach. I would hold AUD for now, awaiting clearer signals from the RBA and China.

Upcoming Australian Economic Indicators

Feb 18th: RBA Rate Decision. Forecast: 4.10%. A cut is widely expected, and the market will focus on the size and forward guidance.

Feb 20th: Unemployment Rate (JAN). Forecast: 4.10%. A higher rate could reinforce RBA easing expectations and weigh on AUD.

Swiss Franc: Franc's Safe-Haven Status in the Spotlight

The dominant theme for the CHF over the past seven weeks has been its safe-haven appeal amid global uncertainty. Political turmoil in South Korea and France, US-China trade tensions, and the tech sell-off have all boosted the CHF. The dominant narrative over the past seven days has been the interplay between the CHF and gold. Gold prices eased below $2,900/oz on Feb 14th after testing record highs, and the CHF appreciated 0.67% against the USD on Feb 13th, likely influenced by gold's movements.

The emerging theme has been the SNB's dovish monetary policy, including the surprise 50 bps rate cut to 0.5% in December. While this initially weakened the CHF, the safe-haven demand has largely overshadowed the SNB's easing bias.

Looking ahead, global risk sentiment will be the key driver for the CHF. Continued risk aversion will likely support the currency, while a return to risk-on sentiment could weaken it. Gold price movements are also crucial, as the CHF often tracks gold. Any comments from SNB officials hinting at further easing or intervention could pressure the CHF. The Industrial Production data for Q4 (due Feb 18th) and the Balance of Trade for January (due Feb 20th) will provide further insights into the Swiss economy.

The fundamental outlook for the CHF is moderately bullish. While the SNB's easing bias is a headwind, the safe-haven demand remains a powerful supporting factor. The COT report (as of Feb 11th) shows mixed positioning, reflecting the uncertainty in the market. I would hold CHF, given the potential for further safe-haven flows, but be mindful of the SNB's dovish stance.

Upcoming Swiss Economic Indicators

Feb 18th: Industrial Production YoY (Q4). Forecast: 0.50%. Weak data could raise concerns about the Swiss economy and weigh on CHF.

Feb 20th: Balance of Trade (JAN). Forecast: CHF4.4B. A smaller surplus could add to CHF weakness.

Euro: Euro's Dovish Dilemma

The dominant theme for the EUR over the past seven weeks has been the ECB's dovish monetary policy and concerns about slowing Eurozone growth. The ECB cut rates to 2.90% on Jan 30th, and markets expect further easing. Weak economic data, including stagnant Q4 GDP growth and rising unemployment in December, add to the bearish sentiment. The dominant narrative over the past seven days has been the mixed signals from economic data and geopolitical developments. The EUR held relatively steady around $1.04, near two-week highs. The upwardly revised Q4 GDP growth (0.1%) and stable employment offered some support, but weak industrial production (-1.1% MoM) and the delay in US tariffs created uncertainty.

The emerging theme is the political uncertainty in Germany and France, with upcoming snap elections in Germany and a new government in France. These political risks are adding to the EUR's woes.

Looking ahead, the ECB's communication will be closely watched for any further dovish signals. The Balance of Trade for December (due Feb 19th) and the preliminary inflation rate for February (due Feb 21st) will be important indicators. US-China trade war developments and political events in Germany and France could also impact the EUR.

The fundamental outlook for the EUR is bearish. The ECB's dovishness, weak economic data, and political uncertainty create significant headwinds. The COT report (as of Feb 11th) shows mixed positioning, with Dealers net short, pointing to downside potential. I would consider selling EUR, but with caution, given the potential for short-covering rallies.

British Pound: Sterling's Uncertain Path

The dominant theme for the GBP over the past seven weeks has been the BoE's dovish monetary policy and concerns about the UK economy. The BoE cut rates to 4.5% on Feb 6th, and the market expects further easing. Weak economic data, including declining retail sales and consumer confidence, and downwardly revised growth forecasts have added to the bearish sentiment. The dominant narrative over the past seven days has been the positive surprise from Q4 GDP data and hopes for delayed US tariffs. The GBP strengthened to a two-month high of $1.2585 on Feb 14th, boosted by better-than-expected Q4 GDP growth (0.1%) and strong December monthly GDP (0.4%).

The emerging theme is the mixed bag of economic signals. While the overall picture is weak, some positive data points in manufacturing and industrial production suggest some resilience.

Looking ahead, the BoE's communication will be closely watched for any further dovish signals. The unemployment rate for December (due Feb 18th) and the January inflation rate (due Feb 19th) will be important indicators. US-China trade war developments could also impact the GBP.

The fundamental outlook for the GBP is bearish, but the recent positive GDP data and potential tariff delays create a more balanced near-term outlook. The COT report (as of Feb 11th) shows mixed positioning, reflecting this uncertainty. I would hold GBP, awaiting clearer signals from the BoE and further economic data.

Upcoming United Kingdom Economic Indicators

Feb 18th: Unemployment Rate (DEC). Forecast: 4.50%. A higher rate could add to BoE easing expectations and pressure GBP.

Feb 19th: Inflation Rate YoY (JAN). Forecast: 2.80%. Higher-than-expected inflation could complicate the BoE's policy decisions.

Canadian Dollar: Loonie's Tariff Troubles and Trudeau's Transition

The dominant theme for the CAD over the past seven weeks has been the weakness driven by US tariff threats and the political uncertainty following Trudeau's resignation. USD strength and the BoC's dovish policy (rate cuts and asset purchases) have added to the pressure. The dominant narrative over the past seven days has been the mixed signals from oil prices, the BoC minutes (released Feb 13th), and economic data. The CAD strengthened past 1.43 per USD, near two-month highs. The BoC minutes expressed concern about US tariffs, hinting at a less dovish stance. However, weaker manufacturing and wholesale sales data tempered the optimism.

The emerging theme is the potential for further BoC easing despite the recent rate cuts, given the ongoing economic uncertainties.

Looking ahead, US-Canada trade relations will be the key driver for the CAD. Any signs of easing tensions could support the currency. Oil price movements are also crucial. The BoC's policy outlook, including the upcoming Monetary Policy Report and rate decision, will be closely watched. The January inflation rate (due Feb 18th) and Q4 GDP growth (due Feb 28th) will be important indicators.

The fundamental outlook for the CAD remains bearish. US tariff threats, BoC dovishness, weak oil prices, and Canadian political uncertainty are significant headwinds. The COT report (as of Feb 11th) shows large net short positions. I would hold CAD for now, given the potential for easing trade tensions and positive oil/economic data surprises.

Upcoming Canadian Economic Indicators

Feb 18th: Inflation Rate YoY (JAN). Forecast: 2.2%. Higher-than-expected inflation could limit BoC easing and support CAD.

Feb 28th: GDP Growth Rate Annualized (Q4). Forecast: 1.20%. Weaker growth could add to CAD weakness.

United States Dollar: Dollar's Trade Tightrope and Tech Troubles

The dominant theme for the USD over the past seven weeks has been the strength driven by safe-haven demand and the Fed's relatively hawkish stance. Trump's trade policies and the tech sell-off fuelled risk aversion, supporting the USD. The Fed held rates steady in January, signalling a pause after three cuts in 2024. The dominant narrative over the past seven days has been a shift towards risk-on sentiment and easing trade tensions. The USD weakened, falling below 107 on Feb 14th, as the tariff delay and hopes for a Ukraine peace deal boosted risk appetite. However, weaker retail sales and rising import prices raised concerns about the US economy.

The emerging theme is the mixed bag of US economic data, with some signs of slowing growth amid the broader strength.

Looking ahead, US-China trade relations will be the key driver for the USD. Further de-escalation could weigh on the currency, while renewed tensions could support it. The Fed's policy outlook, including the upcoming FOMC minutes (Feb 19th), will be closely watched. US economic data, particularly inflation and GDP figures, will be important for gauging the Fed's next move.

The fundamental outlook for the USD is bullish, but with caveats. The safe-haven demand and the Fed's relatively hawkish stance are supportive, but Trump's trade policies and the potential for a US economic slowdown create uncertainty. The COT report (as of Feb 11th) shows mixed positioning. I would hold USD, given the potential for renewed risk aversion and the Fed's data-dependent approach.

Upcoming US Economic Indicators

Feb 19th: Building Permits Prel (JAN). Forecast: 1.45M. A decline could signal weakness in the housing sector.

Feb 19th: Housing Starts (JAN). Forecast: 1.39M. Also important for assessing housing market health.

Feb 19th: FOMC Minutes. Will offer further insight into the Fed's policy thinking and potential future rate cuts.

Feb 21st: Existing Home Sales (JAN). Provides a broader view of the housing market's health.

Feb 27th: Durable Goods Orders MoM (JAN). A key indicator of manufacturing activity.

Conclusion and Key Takeaways

The main themes for the upcoming ten days are central bank policy divergence, US-China trade relations, and the health of the US economy. The RBNZ rate decision and Q4 GDP data will be crucial for the NZD, while the RBA rate decision will be the key driver for the AUD. The CHF will remain sensitive to global risk sentiment and gold prices. The EUR will be influenced by ECB communication and Eurozone economic data, while the GBP will be driven by UK economic data and BoE policy outlook. The USD will be impacted by US-China trade developments, the Fed's policy stance, and US economic data.

Key Economic Indicators To Watch:

RBNZ Rate Decision (Feb 19th) (NZD)

RBA Rate Decision (Feb 18th) (AUD)

FOMC Minutes (Feb 19th) (USD)

Sources

Financial Juice, Bloomberg, Reuters, Trading Economics, ForexLive, Federal Reserve, ECB, BOJ, BOE, RBA, RBNZ, SNB, BOC, US Bureau of Labor Statistics, Eurostat, Statistics Canada, Australian Bureau of Statistics, Statistics New Zealand, Swiss Federal Statistical Office, Office for National Statistics, Cabinet Office Japan, Ministry of Internal Affairs and Communications, Ministry of Finance Japan.