EURO AREA, AND EUR

The Euro Area is split down the middle: services are doing well, but industry is in recession. With inflation falling to 1.7 percent in January, the central bank is in a comfortable position but faces

Saturday, 14 February 2026

The Euro Area is split down the middle: services are doing well, but industry is in recession. With inflation falling to 1.7 percent in January, the central bank is in a comfortable position but faces balanced risks to the outlook.

Feb 20 HCOB Composite PMI Flash. If this misses the 51.7 forecast, it confirms that the manufacturing recession is spreading to services. That would be an immediate sell signal for the EUR.

Mar 19 ECB Monetary Policy Meeting. This is the big one. While most markets expect rates to remain unchanged, any shift in language around the inflation outlook or growth risks could move the EUR. If the ECB signals openness to resuming rate cuts despite holding, expect bond markets to rally and the EUR to weaken.

GOVERNANCE, MONETARY OVERSIGHT, AND ECONOMIC ARCHITECTURE

The Euro Area is currently fighting a battle between a booming services sector in the south (like Spain) and a collapsing industrial core in the north (Germany). The big story for you is the March 19 ECB meeting. With inflation falling to 1.7 percent, the central bank faces questions about whether the current hold stance is appropriate, though it has communicated it is in a “good place.” The deposit facility rate stands at 2.00 percent, and the main refinancing rate at 2.15 percent.

The Eurogroup, Fiscal Policy Dynamics, and Sovereign Governance

If you are tracking the fundamental drivers of the Eurozone, you need to start with the political machinery that keeps this twenty-one nation bloc running. The Eurogroup acts as the primary political steering committee here, currently led by President Kyriakos Pierrakakis. Their mandate isn’t just about balancing books; it is about coordinating economic policies across member states that often have vastly different needs. Right now, their biggest structural project is finishing the European Banking Union. This is critical for you as a trader because the lack of a European Deposit Insurance Scheme remains a vulnerability in the system that can spook markets during banking stress events.

Over the last seven months, we have witnessed a massive shift in how these governments spend money. They have moved away from the blanket stimulus of the pandemic era toward very targeted, strategic spending, specifically in defense. With the North Atlantic Treaty Organisation setting a total spending commitment of 5 percent of gross domestic product by 2035 — comprising at least 3.5 percent for core defence requirements plus up to 1.5 percent for broader defence and security spending — we are seeing a “fiscal reawakening” in Germany. The Germans are loosening their purse strings for infrastructure and defense, which is projected to add about 0.5 percentage points to their gross domestic product in 2026. For you, this means the fiscal drag from Germany might not be as bad as the headlines suggest.

However, you need to be aware of a major risk on the horizon. The European Commission requires that all milestones and targets under the “Next Generation European Union” Recovery and Resilience Facility be achieved by 31 August 2026, with final payments completed by 31 December 2026. This creates a potential “fiscal cliff,” especially for Italy and Spain, who still have huge chunks of unspent funds. Looking ahead to the next seven weeks, keep a close watch on the Eurogroup meeting on 16 February and the ECOFIN summit on 17 February. Finance ministers are going to be debating how to reallocate these funds and, crucially, how to fight back against United States trade tariffs. Any sign of a unified fiscal response could be bullish for the EUR.

The European Central Bank, Monetary Mandate, and Rate Trajectory

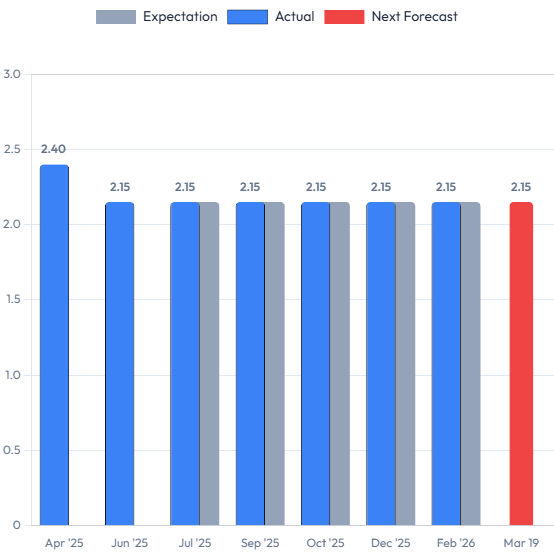

When we look at the European Central Bank (ECB) in Frankfurt, we are seeing a central bank that has communicated it is in a “good place” following eight rate cuts totalling 200 basis points since June 2024. Led by President Christine Lagarde — with Boris Vujčić nominated as the next Vice-President, pending European Council confirmation in March and expected to take office on 1 June 2026 — the Governing Council has one legal job: keeping inflation at 2.0 percent over the medium term. Since ending its rate-cutting cycle with the eighth cut in June 2025, the ECB has held the deposit facility rate at 2.00 percent and the main refinancing rate at 2.15 percent through five consecutive hold decisions at meetings in July, September, October, and December 2025, and February 5, 2026.

They haven’t just held rates; they have also been quietly tightening financial conditions by unwinding their massive bond portfolio (Quantitative Tightening). They stopped reinvesting money from maturing bonds, which pulls liquidity out of the system. Even with this tightening, they have kept the “Transmission Protection Instrument” ready to go, just in case bond spreads between countries like Italy and Germany get too wide. It is a safety net that gives them the confidence to maintain their current stance.

But here is where it gets interesting for your trading strategy over the next seven weeks. The narrative has the potential to shift. Inflation fell to 1.7 percent in January 2026, which is below their target. While most analysts expect the ECB to hold rates through 2026, some policymakers have acknowledged that both cuts and hikes remain equally plausible depending on incoming data. We have a non-monetary meeting on 25 February, but the main event is the monetary policy decision on 19 March 2026. You need to watch the March staff projections like a hawk. If they acknowledge that cheap Chinese imports and US tariffs are going to keep inflation low, they may signal a shift in stance. If they remain firmly in “good place” mode, the hold will persist and expectations for 2027 rate hikes could grow.

Macroeconomic Composition, Industrial Core, and Trade Dynamics

Understanding the Euro Area economy right now requires you to see it as a “two-speed” machine. On paper, it looks stable: the bloc generated approximately 15.5 trillion EUR in gross domestic product last year and grew by 0.3 percent in both the third and fourth quarters of 2025. But those aggregate numbers hide a massive divergence. Spain is the current rockstar, growing 0.8 percent in the fourth quarter thanks to tourism and strong domestic spending. Germany, on the other hand, is the sick man of Europe, posting 0.3 percent growth in the fourth quarter after stagnating in the third and contracting in the second. Its industrial heartland — automotive and manufacturing — is getting hammered by high energy costs and regulation.

Trade flows are also under immense pressure, which is critical for the EUR valuation. Historically, Europe runs a huge trade surplus, but that is at risk. The United States is threatening tariffs that have forced European companies to frantically ship goods early (front-loading) to beat the taxes. On the other side, cheap Chinese electric vehicles and green tech are flooding the market, undercutting European manufacturers. This squeezes the industrial base from both sides — export markets are closing, and domestic markets are being flooded.

Looking at the next seven weeks, the economic outlook is cloudy. Consumer confidence is deep in negative territory at -12.40 points as of January, though this marked the highest reading in nearly a year. The key data point you need to watch is the HCOB Composite Purchasing Managers’ Index coming out on 20 February. This will tell us if the services sector (the part of the economy that is actually growing) is strong enough to carry the dead weight of the manufacturing recession. If that index misses, the EUR could take a hit as growth forecasts get downgraded.

FINANCIAL MARKETS AND ASSET CLASS PERFORMANCE

Financial markets are in a wait-and-see mode, pricing in the ECB’s prolonged hold while monitoring growth and inflation dynamics. Bond yields have edged lower as traders weigh inflation undershooting. Equity markets are split: luxury stocks are booming while heavy industry is crashing. The EUR is caught between the support of stable interest rates and the drag of a weak industrial economy. Watch for bond volatility leading up to the March ECB meeting.

Multidimensional Polarization in Euro Area Markets and Asset Valuations

As you analyze the financial markets in the Euro Area, you are going to notice a theme of extreme polarization. It is a tricky environment where different asset classes are telling different stories about the future. Let’s start with the bond market, which is your best indicator for future rate moves. For the last seven months, with the ECB holding steady, bond yields have fluctuated as markets balance the undershooting inflation against resilient growth and German fiscal expansion. By mid-February 2026, the 10-year Euro Area yield stood at around 3.15 percent. The German Bund, which is the ultimate safe haven, saw its yield at approximately 2.80 percent. This tells you the market sees limited scope for near-term rate changes, though the below-target inflation keeps the door open for eventual easing.

The equity markets are telling an even more divided story. If you look at the EURO STOXX 50 index, it recently hit an all-time high above 6,100 points and is hovering near 6,000, but under the hood, it is chaos. During the recent earnings season, luxury companies like Hermès posted revenue growth of 9 percent at constant exchange rates (5.5 percent at current rates) because rich consumers are still spending. But then look at the industrial giants like Mercedes-Benz — their operating profit collapsed by 57 percent because of Chinese competition and trade tariffs. This divergence is critical for you as a trader: European indices are trading at a discount to the US because they lack the big tech and AI growth engines that are driving Wall Street.

Commodities have been a key factor in the inflation undershoot. Energy prices fell 4.1 percent year-over-year in January. This is helpful for manufacturing margins but pushes headline inflation further below target. At the same time, gold prices have been strong as investors look for a place to hide capital from potential US trade wars and geopolitical tension. For the next seven weeks, keep an eye on Red Sea shipping routes; any disruption there could spike energy prices again and complicate the disinflation picture.

Finally, the currency market. The EUR has been dealing with conflicting forces. On one hand, the ECB holding rates at 2.00 percent while other central banks consider their next moves gives the EUR relative stability. On the other hand, the weak German economy and the threat of US tariffs are dragging it down. Major bank forecasts project the EUR/USD rising toward 1.20 to 1.25 by the end of the year, assuming the US Federal Reserve eventually cuts rates, but expect a lot of chop in the short term as the market digests ECB and Fed policy signals.

TRADING ECONOMICS MACROECONOMIC INDICATORS

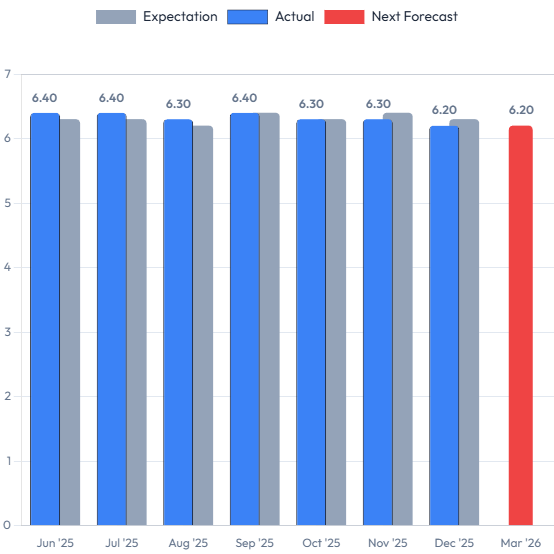

The data is painting a picture of a “low-growth, low-inflation” environment. While it is great that unemployment is at a record low of 6.2 percent, the weak industrial production is a concern. The most critical number on your screen is the 1.7 percent inflation print. This undershoot, combined with resilient growth, means the ECB is likely to maintain its hold stance for now, but continued below-target readings could eventually tilt the balance toward resuming rate cuts.

Interest Rate

Next Release & Forecast: The next big decision lands on 19 March 2026. Models suggest the rate will hold at 2.15 percent for now, with a long-term view that the deposit rate could trend toward 1.75 percent by 2027 according to Trading Economics projections. You should be watching for any shift in language that hints at the ECB’s next directional move.

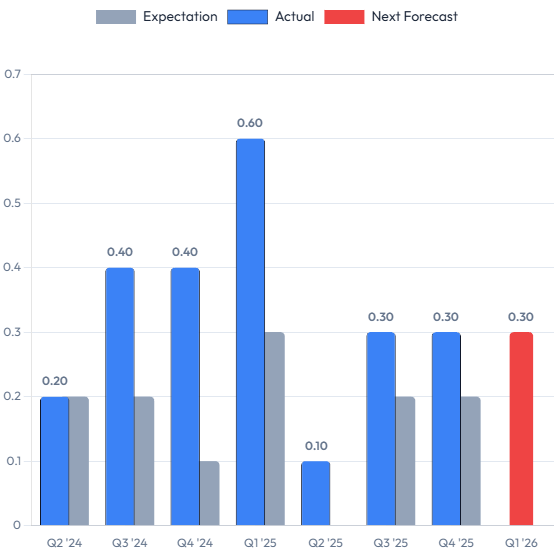

Economic Growth Rate

Next Release & Forecast: We won’t get the flash estimate for Q1 2026 until mid-May. The forecast is for sluggish growth of just 0.30 percent. The consensus is that structural issues in Germany will keep a lid on growth through 2027, so don’t expect a breakout GDP number to save the EUR.

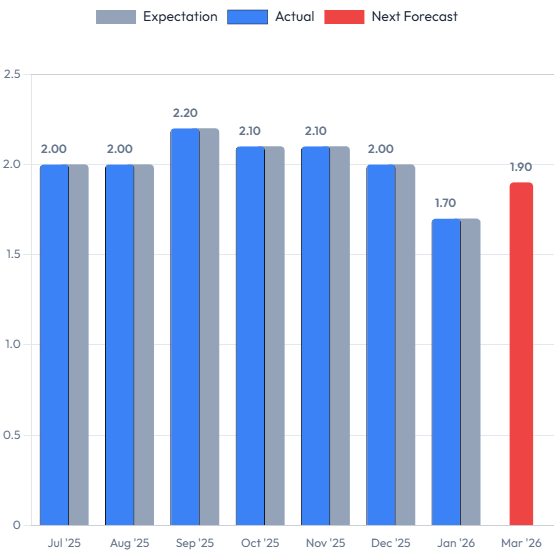

Inflation Rate

Next Release & Forecast: The final reading for February comes out on 03 March 2026. Analysts expect a small bounce back to 1.90 percent. However, the longer-term view is that inflation will hover around 2.00 percent due to rising wages and supply chain costs. This metric is the single most important number for the ECB right now.

Unemployment Rate

Next Release & Forecast: January data drops on 04 March 2026. The forecast is for unemployment to stay at a record low of 6.20 percent. This tight labor market is the main thing keeping the economy afloat, as companies are hoarding workers despite weak growth.

Employment Change

Next Release & Forecast: We are waiting until mid-May for the next update. Expectations are for a slowdown to 0.10 percent growth. This reflects the reality that while services are hiring, the industrial sector in Germany is starting to cut back.

Other Economic Indicators (Upcoming Two Weeks)

Feb 16, 2026: Industrial Production MoM (Dec 2025). Forecast: -1.2 percent (Consensus: -1.5 percent).

Feb 17, 2026: ZEW Economic Sentiment Index (Feb 2026). Forecast: 44.0 (Consensus: 45.2).

Feb 19, 2026: Consumer Confidence Flash (Feb 2026). Forecast: -12.2 (Consensus: -12.0).

Feb 20, 2026: HCOB Composite PMI Flash (Feb 2026). Forecast: 51.7.

Feb 20, 2026: Negotiated Wage Growth (Q4 2025). Forecast: 2.0 percent.

Feb 25, 2026: Core Inflation Rate YoY Final (Jan 2026). Forecast: 2.2 percent.

Gavin Pearson has been studying the currency markets as a retail trader for twenty years.

The aim of this site is to provide high quality, and accurate Fundamental Analysis that can be used to complement your own research.

Updates are made on a daily basis so bookmark these links.

DISCLAIMER: This site is informational only, NOT financial advice. Trading involves risk, and you could lose money.