NEW ZEALAND, NZD, AND DAIRY

For forex traders, the NZD offers a stabilising profile that hinges on the central bank holding its nerve and dairy prices staying strong. Sentiment is cautiously bullish, supported by a cash rate hol

Friday, 20 February 2026

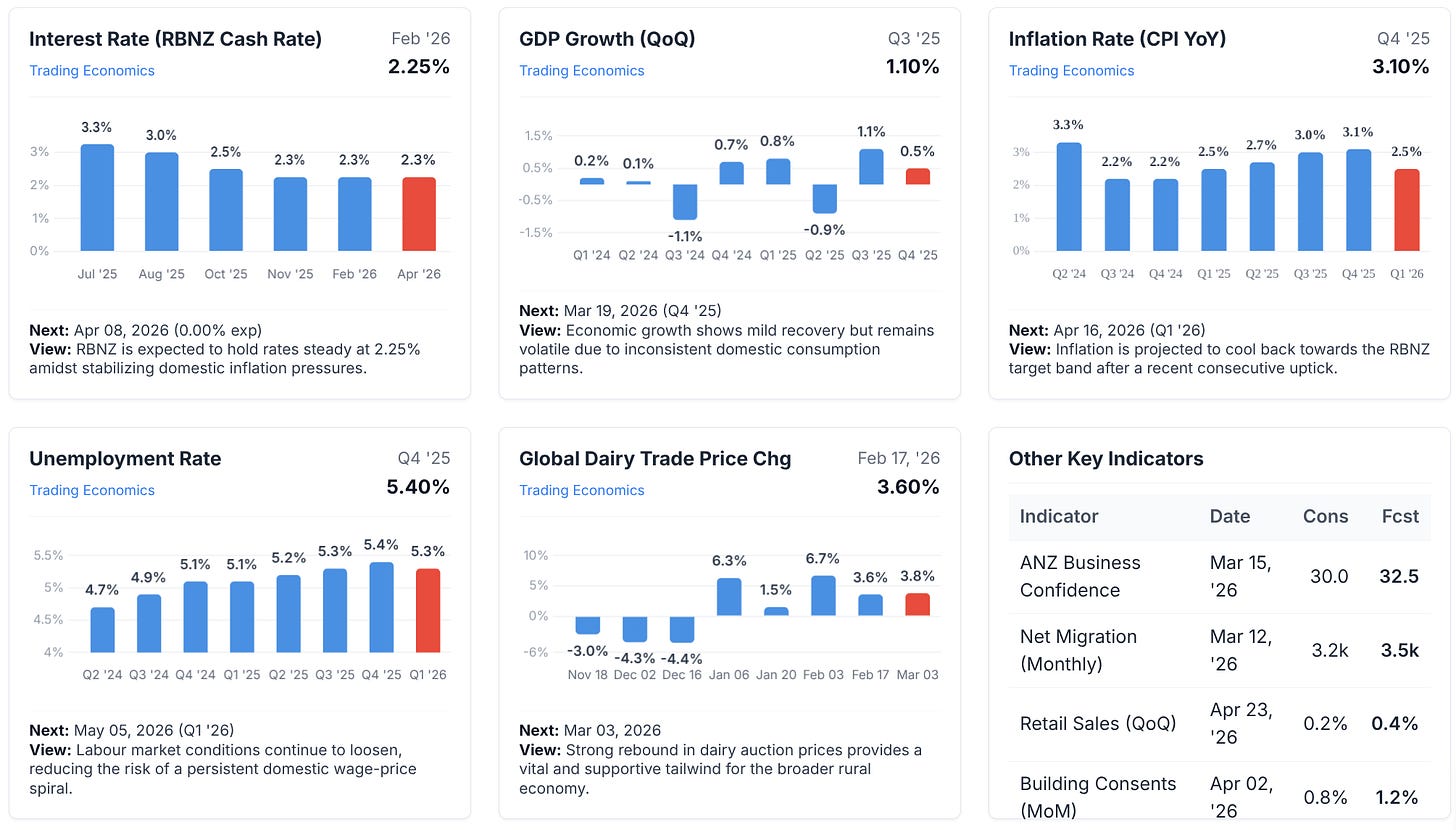

For forex traders, the NZD offers a stabilising profile that hinges on the central bank holding its nerve and dairy prices staying strong. Sentiment is cautiously bullish, supported by a cash rate holding at 2.25 percent as the RBNZ juggles a recovery with a 3.1 percent inflation spike. While yield spreads are tight, the kiwi is finding support from surging dairy auctions, though you need to watch out for US tariffs and shaky Chinese demand.

Macroeconomic and Political Landscape of New Zealand

Demographic Profile, Economic Structure, and Political Mandate

New Zealand is a sophisticated island nation home to approximately 5.34 million people who enjoy a very high quality of life, with a Human Development Index of 0.938. The country maintains a strong voice on the international stage, holding active and strategic memberships in key organisations like the OECD, APEC, and the CPTPP.

The economy is a developed free-market system generating roughly 248 billion USD in gross domestic product, heavily reliant on a services sector that makes up 73 percent of output and a vital agricultural engine contributing 7 percent. Trading partners include China, Australia, and the US, with the economy exporting over 95 percent of its dairy production, making whole milk powder a critical revenue stream.

The government operates as a parliamentary democracy under a constitutional monarchy, currently led by Prime Minister Christopher Luxon and Deputy Prime Minister David Seymour. Domestic economic strategy is managed by Finance Minister Nicola Willis, who steers the Sixth National Government following their election victory in late 2023.

With a term running through to late 2026, the administration is laser-focused on its ‘Going For Growth’ agenda to wipe out structural deficits and cut red tape. Their mandate includes an ambitious target to double primary sector exports by 2034 and implement technology to lower agricultural emissions by 2030.

August 2025: The government tightened fiscal belts under the Going For Growth strategy while dealing with new US tariffs on exports.

September 2025: Policymakers rushed to fast-track infrastructure projects to jumpstart corporate spending after the economy contracted in the second quarter.

October 2025: Trade officials pivoted hard to find new export markets, trying to shield farmers from global trade fragmentation.

November 2025: Finance Minister Willis backed the central bank’s rate cuts, calling them essential to help families fighting the cost of living.

December 2025: The Treasury confirmed the budget was still in deficit, forcing the government to double down on debt reduction promises.

January 2026: Prime Minister Luxon kicked off the election year with a State of the Nation address outlining the final legislative push.

February 2026: Inflation popped back up to 3.1 percent, but the Finance Minister brushed it off as a temporary blip.

Central Bank Strategy and Leadership

The Reserve Bank of New Zealand, known as Te Pūtea Matua, is a heavyweight in the financial world for pioneering the inflation-targeting framework. It operates independently to keep the financial system stable, managed by an Executive Leadership Team that oversees everything from financial stability to money operations.

Governor Dr. Anna Breman is currently at the helm, using her experience from the Swedish Riksbank to steer the economy through choppy waters. The Bank relies on its Monetary Policy Committee to debate the data and make the final call on the Official Cash Rate, ensuring they can move fast when conditions change.

Governor Breman serves a five-year term that runs until November 2030, with a strict mandate to keep inflation between 1 and 3 percent, aiming for the 2 percent midpoint. The Committee meets seven times a year to set rates, though they plan to increase this to eight meetings starting in 2027 to stay in sync with global peers.

August 2025: The Committee cut the cash rate to 3.00 percent to breathe life into a shrinking economy.

September 2025: The Bank admitted that global tariffs were hurting the recovery, signalling that low rates were here to stay.

October 2025: They cut rates again by 50 basis points to 2.50 percent, confident that core inflation was calming down.

November 2025: The rate was slashed to 2.25 percent, the lowest in years, as they bet on inflation normalizing.

December 2025: Dr. Breman officially took charge, promising to be transparent and tough on price stability.

January 2026: Despite inflation heating up in the fourth quarter, Governor Breman talked down the need for immediate hikes.

February 2026: The Committee held rates steady at 2.25 percent, balancing the need for growth against sticky inflation.

https://www.rbnz.govt.nz/

Key Economic Performance Metrics

The central bank watches four main areas to make its decisions. They track Inflation Dynamics via the CPI to meet their price stability goals, and they monitor Economic Growth through GDP to see if the economy is running hot or cold. They also keep a close eye on Labour Market Conditions to spot wage pressure, and they analyze Global Dairy Trade prices because milk exports effectively determine the value of the New Zealand dollar.

Gavin Pearson has been studying the currency markets as a retail trader for twenty years.

The aim of this site is to provide high quality, and accurate Fundamental Analysis that can be used to complement your own research.

Updates are made on a daily basis so bookmark these links.

DISCLAIMER: This site is informational only, NOT financial advice. Trading involves risk, and you could lose money.

Absolutly brilliant analysis of NZ's economic pivot from recession to recovery. The connection between dairy price rebounds and currency stability is spot-on, dunno if many analysts catch that linkage as clearly. I remember watching commodity markets during Australia's mining boom and the parallels in export-driven currency dynamics are striking. Your point about the divergence between surging business confidnce and lagging unemployment data really captures the current tension perfectly.