SWITZERLAND, CHF, AND GOLD

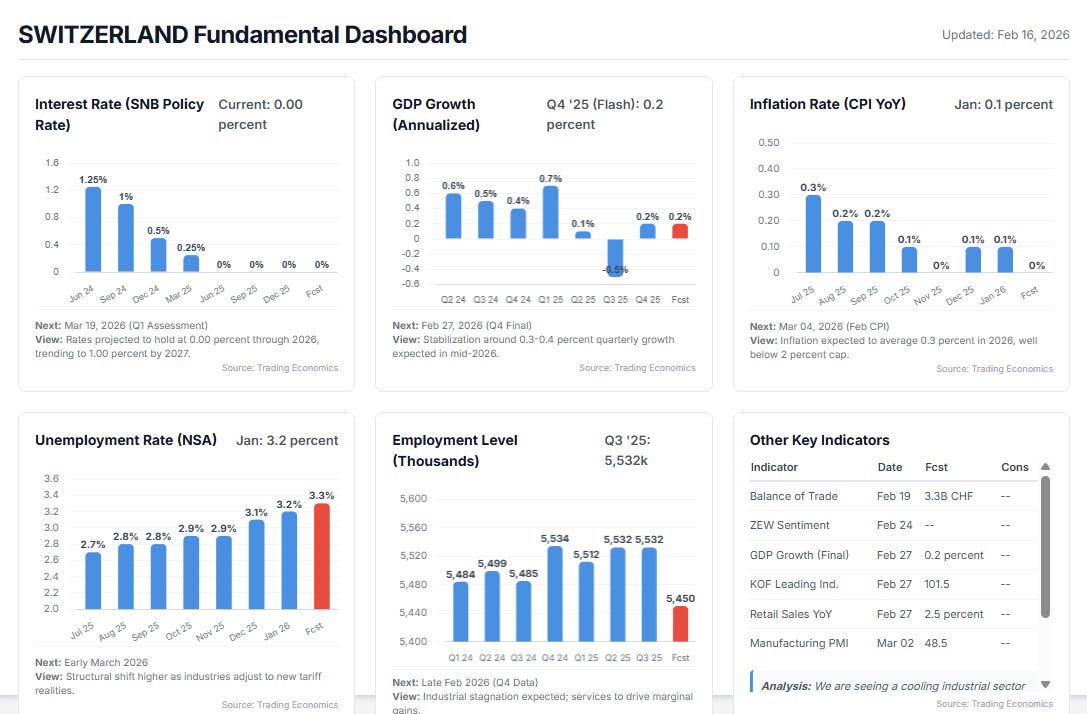

Switzerland has managed to stabilize after the 2025 tariff shock, but it has come at the cost of industrial contraction and rising unemployment. The SNB is locked at 0.00 percent to fight disinflation

SWITZERLAND, CHF, AND GOLD

Monday, 16 February 2026

Switzerland has managed to stabilize after the 2025 tariff shock, but it has come at the cost of industrial contraction and rising unemployment. The SNB is locked at 0.00 percent to fight disinflationary pressures, while the Swiss Franc and Gold remain high-value bunkers against global chaos. The outlook now hinges on the US “Warsh Effect” not crushing global risk appetite.

Feb 27 Q4 GDP (Final) Confirmation of the 0.2 percent rebound is vital to rule out a double-dip recession.

Mar 04 Consumer Price Index (CPI) A further decline toward zero or negative territory could force the SNB to discuss negative rates, weakening the CHF.

PARMELIN’S PRESIDENCY NAVIGATES TARIFF FALLOUT AND FISCAL TIGHTENING

Switzerland is settling into a “low-altitude” flight path. The government has capped the trade war risk, but the cost is a permanent drag on the industrial sector. With fiscal austerity kicking in and the SNB stuck at zero percent rates, the economy lacks organic growth drivers. The rising unemployment rate is the key red flag, suggesting that the recovery will be a slow grind rather than a quick bounce.

PRESIDENT PARMELIN BALANCES TRADE SURVIVAL WITH AUSTERITY MEASURES

In the complex landscape of Swiss politics, 2026 has kicked off under the leadership of President Guy Parmelin (SVP/UDC). Elected by the Federal Assembly in December 2025, Parmelin is no stranger to crisis management. As he retains his role heading the Federal Department of Economic Affairs, Education and Research (EAER), he is uniquely positioned to handle the economic fallout from the previous year’s trade shocks. His mandate for this year is clear but challenging: execute the “Trade Survival” agenda. You will recall that Parmelin was instrumental in negotiating the reduction of punitive United States tariffs from a crippling 39 percent down to 15 percent last November. While this was a diplomatic victory that stabilized the export sector, he now faces the reality that Swiss industry must operate with a cost base significantly higher than its historical norm (https://www.lemonde.fr/en/international/article/2025/12/10/guy-parmelin-elected-switzerland-s-next-president_6748357_4.html).

On the fiscal front, the government is tightening its belt, which is a key theme you need to watch. The Federal Assembly barely scraped together a budget for 2026, targeting a razor-thin surplus of 84.6 million CHF on spending of 91.1 billion CHF. But the real story is the looming austerity. To combat structural deficits worsened by trade protectionism, the government has proposed massive cuts aiming to save 2.4 billion CHF in 2027, ramping up to 3.1 billion CHF by 2029. This isn’t just numbers on a page; it involves deep cuts to public services and infrastructure that are facing stiff resistance in parliament. Over the next seven weeks, the Federal Council has to finalize the implementation plan for these cuts by the May 2026 deadline. Expect political friction to heat up as the manufacturing sector lobbies hard for support to offset the lingering United States tariffs, potentially complicating Parmelin’s consolidation goals (https://www.devere-switzerland.ch/news/Switzerland-unveils-bold-plan-for-major-spending-cuts).

SNB MAINTAINS ZERO PERCENT RATE POLICY WHILE FIGHTING SAFE HAVEN INFLOWS

If you are tracking the Swiss National Bank (SNB), you know that Chairman of the Governing Board Martin Schlegel has been navigating a minefield since taking the helm in October 2024. The central bank’s policy path over the last several months has been an aggressive race to the bottom, executing six consecutive rate cuts that brought the policy rate from 1.50 percent down to 0.00 percent by June 2025. Since then, we have seen a stubborn holding pattern. The SNB has resisted the market’s call for negative interest rates, despite clear disinflationary signals, effectively drawing a line in the sand at the zero lower bound (https://www.snb.ch/en/the-snb/organisation/supervisory-management-boards).

The current dilemma for monetary policy is what we call the “Safe Haven Paradox.” Domestically, Switzerland is flirting with disinflation—Consumer Price Index (CPI) inflation was just 0.1 percent year-on-year in January 2026, barely above zero. Normally, this would scream for rate cuts. However, the Swiss franc (CHF) remains relentlessly strong due to global geopolitical risks, acting as a magnet for capital flight. Chairman Schlegel has made it clear that he views negative rates as a last resort due to the damage they do to the banking sector. Instead, the SNB is relying heavily on foreign exchange interventions to stop the franc from crushing exporters. Looking at the next seven weeks, all eyes are on the March 19 assessment. With the “Warsh Effect” driving volatility in global yields and domestic inflation near zero, traders are questioning how long Schlegel can rely solely on FX intervention before the disinflationary pressure forces his hand (https://tradingeconomics.com/switzerland/interest-rate).

SWISS ECONOMY FACES A TWO-SPEED REALITY WITH RISING UNEMPLOYMENT

When you look under the hood of the Swiss economy, you see a stark divide. We are currently witnessing a “two-speed” reality where high-value sectors like finance and pharmaceuticals are carrying the weight, while traditional precision manufacturing and watchmaking are taking a beating. The damage from the United States trade dispute was tangible, contributing to a sharp GDP contraction of 0.5 percent in the third quarter of 2025. However, there is resilience here; full-year 2025 growth is estimated at 1.4 percent, largely thanks to front-loaded exports early in the year and a service sector that refuses to quit. Given that Germany and the United States are the biggest buyers of Swiss goods, the 15 percent tariff regime remains a heavy anchor on growth (https://tradingeconomics.com/switzerland/gdp-growth).

The economic development over the last seven months has been a rollercoaster. After that ugly Q3 contraction, today’s flash estimates for Q4 2025 show a modest rebound of 0.2 percent. It is a stabilization, but certainly not a boom. The real concern for you as an analyst should be the labor market. Unemployment has drifted up to 3.2 percent in January 2026, a significant jump from the 2.7 percent we saw in mid-2025. This tells us that industrial firms are shedding labor to protect margins. Over the next seven weeks, the market focus will shift to the “implementation phase” of the new trade deal. While the KOF Economic Barometer suggests momentum is subdued, the service sector needs to do some heavy lifting. If the franc stays this strong, the tourism and machinery sectors will continue to struggle, making the recovery in early 2026 look very fragile (https://investinglive.com/news/swiss-economy-estimated-to-grow-by-14-overall-in-2025-20260216/).

STOCKS HIT HIGHS WHILE BONDS PRICE IN STAGNATION

Financial markets are betting on a “goldilocks” scenario of zero rates and strong multinational earnings, completely ignoring the domestic industrial recession. The big risk ahead is a sharp repricing of global yields driven by the US Fed. If US rates spike, it could crush gold and weaken the franc simultaneously, unraveling the safe-haven trade that has worked so well for the last year.

SAFE HAVEN DEMAND DRIVES DIVERGENCE ACROSS ASSET CLASSES

Bond Market: If you look at the Swiss sovereign bond market, it is pricing in a long winter of stagnation. The 10-year government bond yield has been crushed, trading around 0.27 percent as of mid-February 2026. To put that in perspective, yields were around 0.40-0.45 percent in mid-2025. This compression is the direct result of the SNB’s zero-interest-rate policy and an unrelenting global demand for safe assets. The short end of the curve is inverted, with 2-year yields sitting at negative 0.13 percent. Essentially, investors are paying for the privilege of parking cash in CHF to hedge against global chaos. Over the next seven weeks, keep an eye on US Treasuries; the recent “Warsh Effect” caused a blip in global yields, but the disinflationary reality inside Switzerland puts a hard concrete ceiling on how high Swiss yields can go (https://tradingeconomics.com/switzerland/government-bond-yield).

Stock Market: The Swiss Market Index (SMI) is telling a completely different story, having hit an all-time high of 13,674 points in February 2026. This disconnect might seem confusing given the economic data, but it is driven by the “defensive growth” status of the index’s heavyweights. Investors are rotating into giants like Nestle, Roche, and Novartis, treating them as bond proxies that pay reliable dividends. The index rallied over 14 percent late last year after the tariff deal was signed. However, be cautious in the coming weeks. If US yields continue to rise or if we see earnings downgrades from the industrial sector, this rally could run out of steam. Forecasts suggest a potential pullback to around 13,400 if the “risk-on” mood fades (https://tradingeconomics.com/switzerland/stock-market).

Commodities Market: Gold (XAU) has been the wildest ride in town. After skyrocketing to a record high near 5,600 USD per ounce in late January, we saw a historic “flash crash” on January 31 triggered by the Warsh nomination and margin hikes, which took it down to roughly 4,700-4,900 USD. This was a leverage flush triggered by higher margins and the “Warsh Effect.” However, prices have stabilized around the 5,000 USD level. For Swiss traders, gold is a critical correlated asset to the franc. With central banks still buying and geopolitical fear lingering, any renewed weakness in the USD could easily push gold back toward 5,200 USD in the next few weeks (https://www.fxleaders.com/news/2026/02/15/gold-price-forecast-can-xau-usd-reclaim-5146-as-the-5000-floor-firms/).

Currency Market: The Swiss franc (CHF) remains the king of safe havens, although the resurgent US dollar is providing some headwinds. USD/CHF is trading near 0.7684, reflecting a significant appreciation of the franc over the last six months. This strength is a double-edged sword: it kills imported inflation but chokes exporters. Against the Euro, the franc remains strong with EUR/CHF implying levels around 0.912. The next seven weeks will be a tug-of-war. The SNB is threatening intervention to weaken the currency, while global capital keeps flooding in. If USD/CHF breaks 0.7600, expect the SNB to get very loud, very fast (https://www.exchangerates.org.uk/currency-forecasts/us-dollar-to-swiss-franc-forecast).

SNB LOCKED AT ZERO AND DISINFLATION PERSISTS: KEY DATA WATCH

The data confirms a “low-altitude” flight path for the Swiss economy. With inflation hovering at just 0.1 percent in January, the SNB has absolute freedom to keep rates at zero. However, the rising unemployment trend (3.2 percent) and stagnant payrolls reveal the real cost of the 2025 tariff shock. Sentiment is fundamentally dependent on the Manufacturing PMI due on March 2; a continued contraction would signal that the service sector cannot carry the economy alone indefinitely.

Gavin Pearson has been studying the currency markets as a retail trader for twenty years.

The aim of this site is to provide high quality, and accurate Fundamental Analysis that can be used to complement your own research.

Updates are made on a daily basis so bookmark these links.

DISCLAIMER: This site is informational only, NOT financial advice. Trading involves risk, and you could lose money.