Forex Briefing (WN08 2026): THE HAWKISH DIVERGENCE PLAY

The market mood is defined by Hawkish Divergence. Investors are dumping currencies with dovish central banks (GBP, CHF, EUR) and piling into high-yield fortresses (USD, AUD, NZD). The collapse of the

The market mood is defined by Hawkish Divergence. Investors are dumping currencies with dovish central banks (GBP, CHF, EUR) and piling into high-yield fortresses (USD, AUD, NZD). The collapse of the gold trade has accelerated flows into the US Dollar, while political instability in the UK is generating a specific risk premium on Sterling assets.

What to watch:

US Markets closed on Monday for Presidents’ Day (low liquidity expected, watch for gaps).

UK CPI on Wednesday

Australia Labour Force on Thursday, Feb 20.

The Markets to Trade

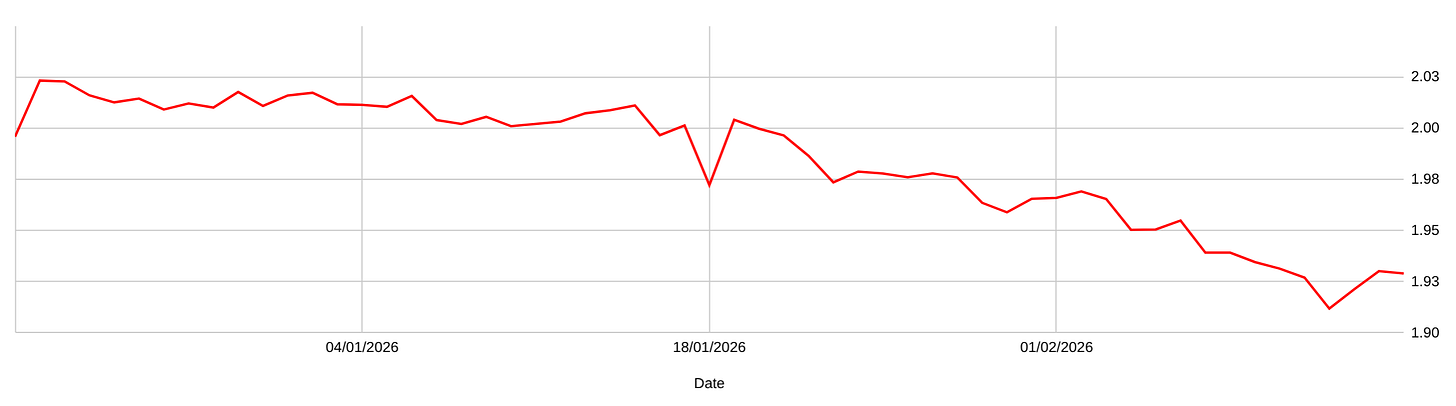

GBP/AUD: Highly Convincing BEARISH INFLUENCE over the coming weeks due to central bank divergence

This trade is purely about the “tale of two central banks.” On one side, you have the British Pound, which is currently collapsing under the weight of a stagnant economy and political scandal. The Q4 GDP print of just 0.1 percent was a disaster, missing the 0.2 percent consensus and confirming that the UK growth engine is sputtering (https://tradingeconomics.com/united-kingdom/gdp-growth). On the other side, the Australian Dollar is enjoying a renaissance after the RBA decided to hike rates to 3.85 percent on February 3, backed by a tight labor market with unemployment sitting at 4.1 percent (https://www.abs.gov.au). Looking forward, the pressure on the GBP is only going to get worse. The Bank of England is effectively cornered; they need to cut rates to 3.50 percent in March to save the economy, but inflation is still sticky. Meanwhile, the RBA is signaling they might hike again to kill off 3.8 percent inflation. We have the UK CPI coming up this Wednesday, Feb 18, which will likely confirm the “sticky inflation, zero growth” trap. Then, on Thursday, Feb 20, Australian labor data could cement bets for a May hike. This fundamental mismatch makes selling rallies in GBP/AUD one of the highest-conviction plays on the board.

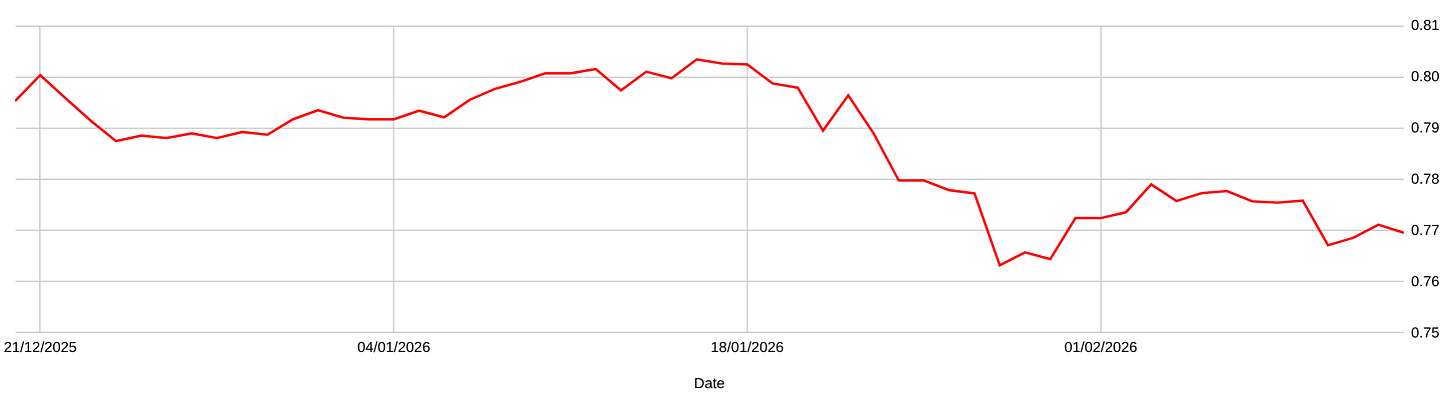

USD/CHF: Highly Convincing BULLISH INFLUENCE over the coming weeks due to yield spread

The USD/CHF pair has broken out, and it is being driven by a massive shift in global capital flows that you need to be on the right side of. The US Dollar has roared back to life following the nomination of hawk Kevin Warsh as Fed Chair and a robust 130,000 jobs report that completely crushed any lingering recession fears (https://www.dol.gov/newsroom/economicdata/empsit_02112026.pdf). Conversely, the Swiss Franc has lost its main support pillar: gold. The 1.4 trillion USD liquidation event in precious metals last Friday, combined with Swiss domestic inflation turning negative at -0.1 percent, has left the CHF vulnerable (https://www.mexc.co/en-PH/news/700334). Moving forward, the bullish trend is expected to dominate. The US “no landing” scenario suggests the Fed will hold rates steady in March, maintaining a massive yield advantage over the Swiss National Bank’s 0.00 percent policy. With the SNB actively fighting deflation and the US attracting yield-seeking capital, the upcoming US Q4 GDP data on February 20 is likely to provide the next catalyst for further USD/CHF upside.

Gavin Pearson has been studying the currency markets as a retail trader for twenty years.

The aim of this site is to provide high quality, and accurate Fundamental Analysis that can be used to complement your own research.

Updates are made on a daily basis so bookmark these links.

DISCLAIMER: This site is informational only, NOT financial advice. Trading involves risk, and you could lose money.